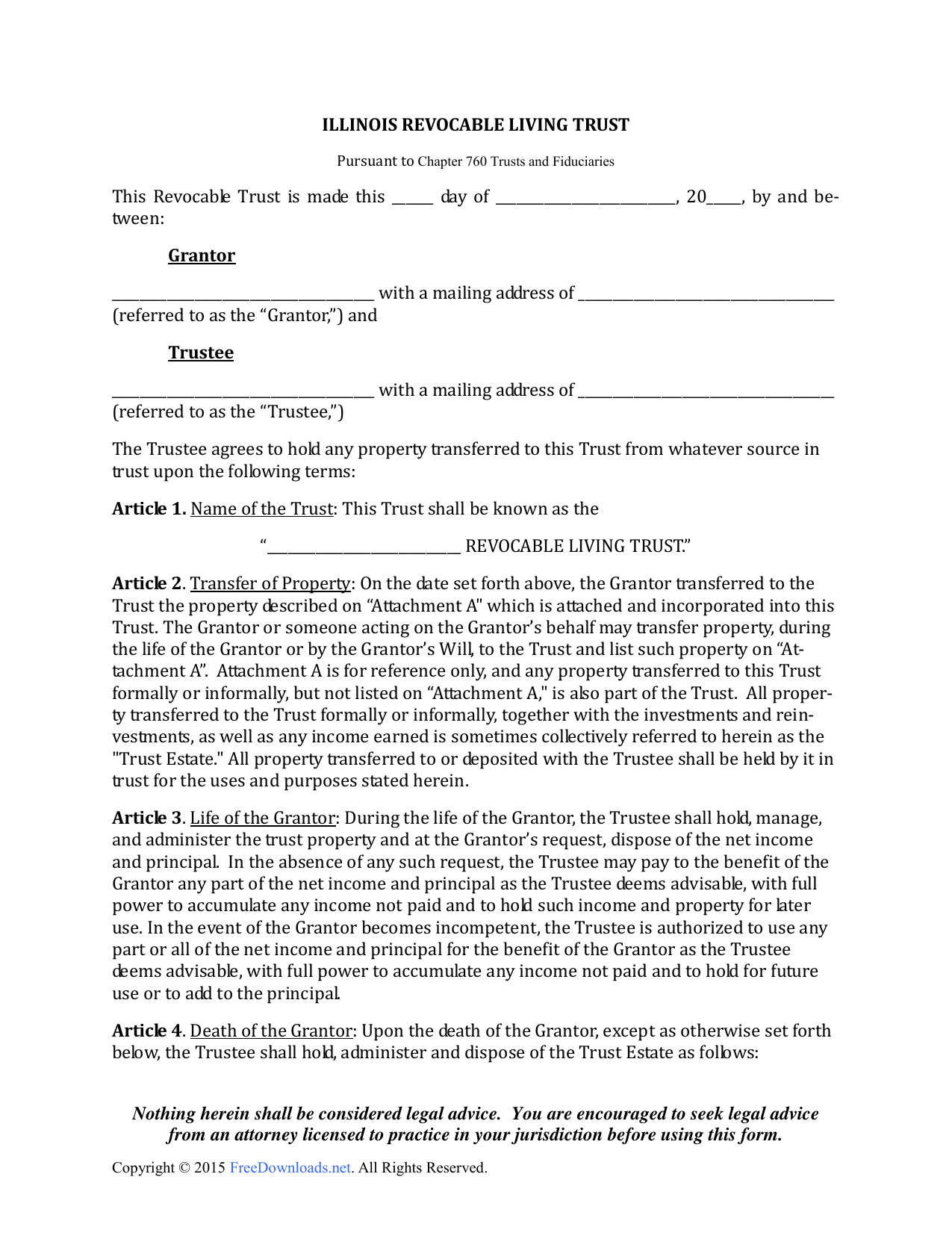

Illinois revocable living trust form the illinois revocable living trust is an entity into which a person places their assets to save the inheritors the long and costly probate process in illinois.

Revocable living trust illinois form.

The revocable liv ing trust.

Illinois state bar association.

How do i put money and other assets in a living trust accessed march 16 2020.

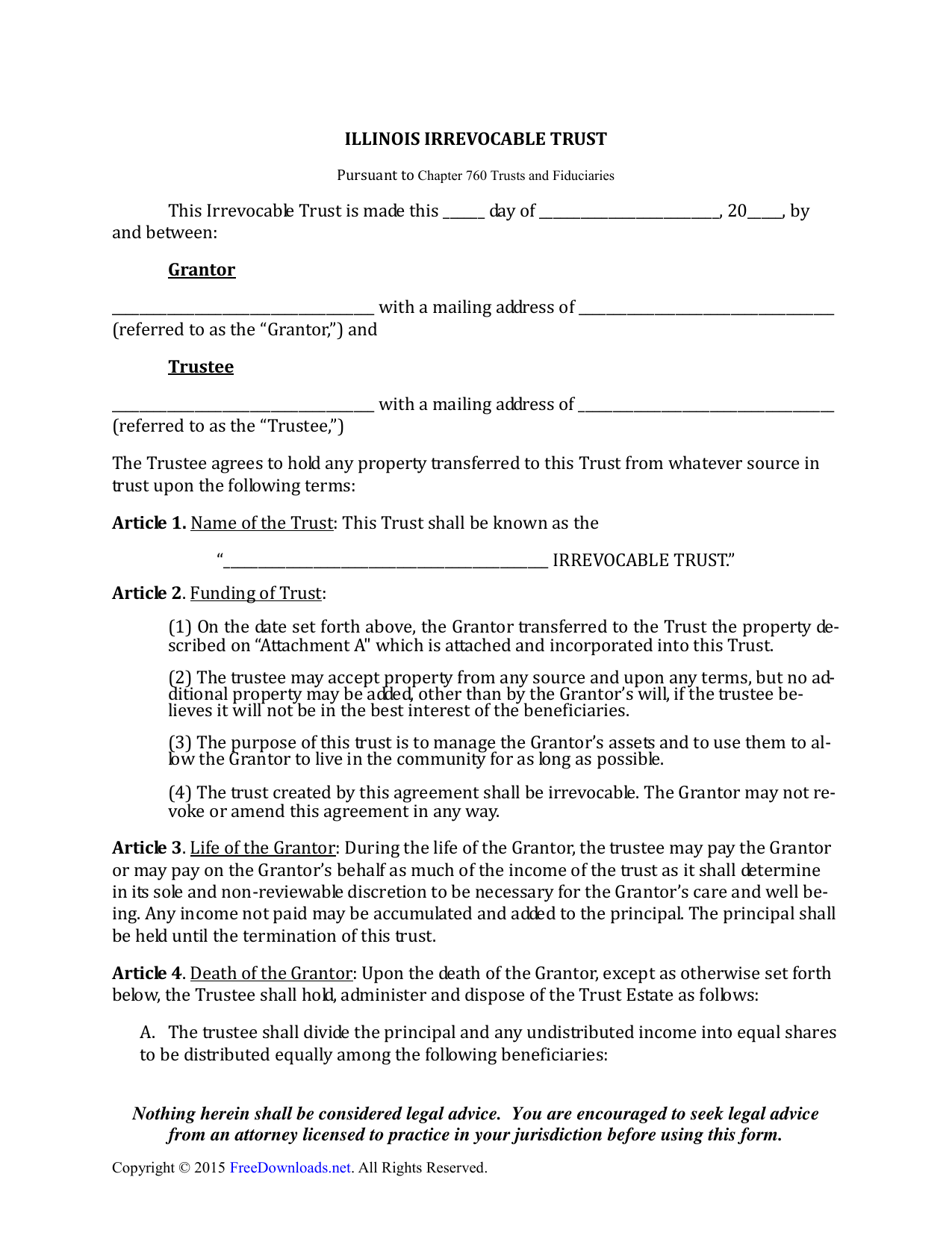

In its simplest form a trust is the designation of a person or corporation to act as a trustee to deal with the trust property and administer that property in accordance with the instructions in the trust document.

Living trusts if i have a living trust do i still need a will accessed march 16 2020.

Illinois living trust form irrevocable revocable an illinois living trust is a document that allows the recipient s of a deceased individual s assets to avoid the court supervised probate process implemented after a person dies.

Your guide to a living trust how are assets distributed at your death accessed march 16 2020.

Illinois does not use the uniform probate code which simplifies the probate process so it may be a good idea for you to make a living trust to avoid illinois s complex probate process.

A living trust is a trust established during a person s lifetime in which a person s assets and property are placed within the trust usually for the purpose of estate planning.

How do i choose between a revocable living trust and an irrevocable living trust.

The initial creator of the trust referred to as the grantor will transfer property and assets to the.

Unlike a will which takes effect upon a person s death when an individual uses this kind of estate planning it goes into effect during their lifetime.

Illinois revocable living trust form.

Superior court of california.

The answers to these questions will give you a general overview of the advantag es and disadvantages of using a living trust as your primary estate planning document.

Some illinois residents choose to plan their estates and get their affairs in order using revocable living trusts.

What is a trust.

Aside from avoiding probate the grantor person who establishes the trust has continued access to their assets if they become incapacitated in any.

A living trust also called a revocable trust or an inter vivos trust goes into effect during your lifetime and is.

To put it simply when you create a revocable living trust you still have a form of control in being able to change or terminate the trust therefore it is.

The answer will depend on your circumstances and your reason for wanting to make a trust agreement.

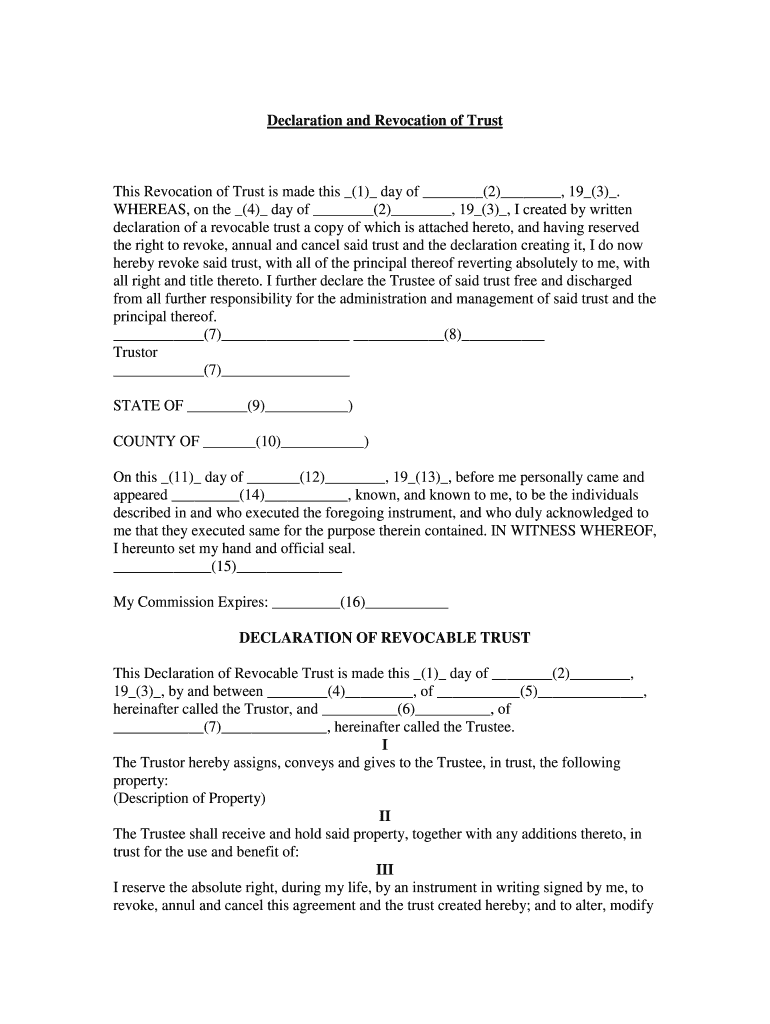

This revocation of living trust form is to revoke a living trust.